RZH Insights – The Stock Market in 2022 – Bumps and Bruises

Dear Clients and Friends of RZH:

After a wonderful 2021 and an all-time high reached on January 3rd, the stock market is off to one of its worst starts ever with the S&P 500 falling 9% in January. Small cap stocks have declined 14% and the tech-focused NASDAQ has dropped 15%.

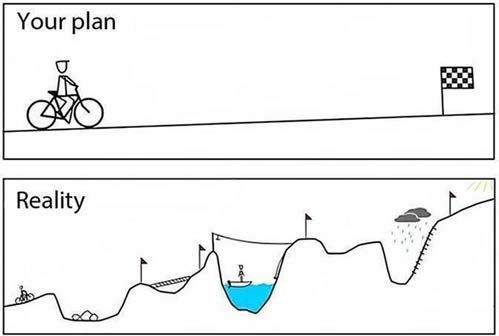

All of us at RZH understand how stressful this is and why you may be worried. Volatility of this magnitude can certainly have you upset about lower portfolio values and make you potentially question your plan.

The cause of this volatility has to do with investor concerns over how the Federal Reserve (the Fed) is planning to fight inflation, which is at a 40-year high. Specifically, investors worry about the Fed’s ability to temper escalating inflation without hampering the growing economy. Some fear the Fed has been too slow to act and will launch an aggressive rate-hike strategy. And if interest rates rise significantly, they also worry the economy and corporate earnings may suffer. Higher interest rates make it more expensive for people to borrow money for purchases such as homes, cars, and major appliances. It also leads to higher costs for companies to finance new plants, equipment, and acquisitions. Cumulatively this stalls economic growth. Higher interest rates also cause the capital markets to reprice the value of all investments relative to one another – as interest rates are an important component of valuation models. And if this was not enough, there are still lingering supply chain issues, a persistent pandemic, and geopolitical tensions between Russia and Ukraine.

While the declines have been sudden, they are not unusual in order of magnitude. As noted in my December 2018 memo, 10% corrections happen about once every 15 months – it’s just that they don’t usually happen over four weeks! So, while the velocity of the decline is unusual the actual decline (9% so far) is not – relative to how stocks behave historically. Also, the stock market has typically reacted negatively to past interest rate hikes by the Fed. Because of this, we are not worried about “why” all of this is happening.

To illustrate this in more relevant context: over the last five years the global stock market is up 100% and the S&P 500 by itself is up 133%. A 10% correction is perfectly normal, healthy and is to be expected after such an extraordinary run.

Due to historically frequent corrections, it is important to avoid pinning your portfolio value to its all-time high value and then worry about losing money from that high point. The stock market fell 20% in late 2018 and 35% in early 2020. Pullbacks are simply a reality of being an equity investor. Since we accept that the stock market cannot be consistently timed by us or anyone, we believe that the only way to be sure of capturing the full premium return of stocks is to ride out their frequent but ultimately temporary declines.

So, what do we do at a time like this? We continue to work on your long-term plan and look for opportunities to be proactive. This could involve tax-loss harvesting, rebalancing, or deploying cash on the sidelines. We also stay disciplined to the RZH financial control of maintaining 5-7 years of cash flow needs invested in cash and bonds. This allows for consistency of lifestyle during volatile markets and avoids the need to sell stocks when it is not opportune to do so.

All of us at RZH understand our role as stewards and guardians of your capital and truly appreciate the faith and trust you have placed in us. Please know that we are completely focused on these events and are monitoring your portfolios and investments closely. Please feel free to reach out to us for an analysis of your personal portfolio and plan.

Best Regards,