RZH Insights – Practicing Rationality in the Midst of Uncertainty

Dear Clients and Friends of RZH,

After the S&P 500 Index rose 28.1% in 2021, the stock market cooled off and has slipped 4.6% in 2022 (as of March 31st). It must have been an uneventful quarter…right? Can you believe that after all the events of the past three months, the S&P 500 is only down about 4%?

On February 24th Russia invaded Ukraine. On that day, I sent a letter (which can be found here) discussing the events and our thoughts about your investment portfolio. One of the points I made discussed average intra-year drawdowns for the S&P 500. I want to reiterate this point because, thus far, 2022 has been playing out similar to historical norms.

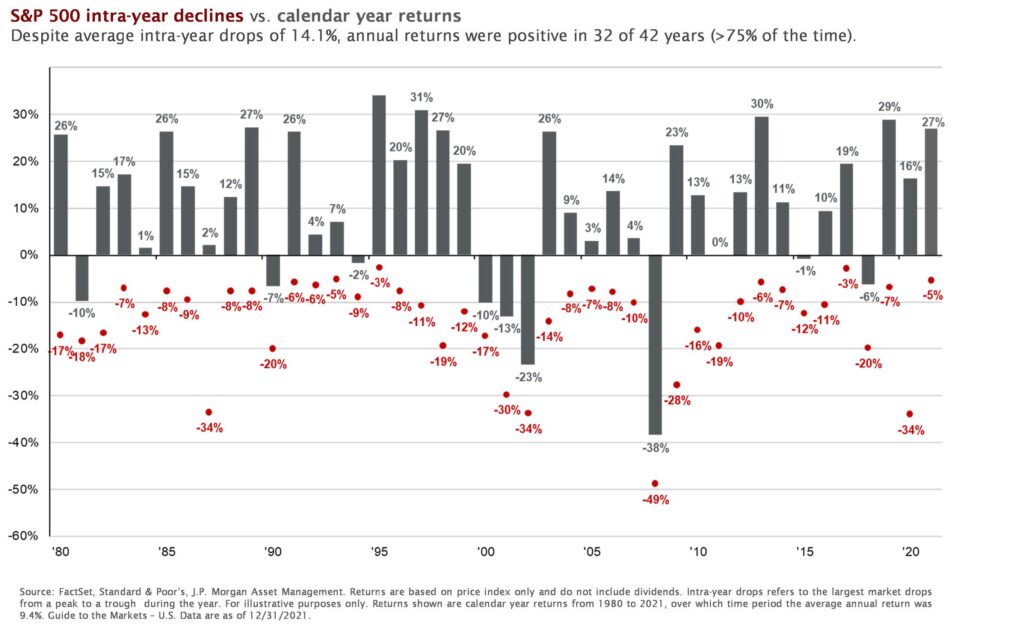

Since 1980, the S&P 500 index has exhibited average intra-year declines of 14.1%. Despite this, as shown in the below graph, the index has finished the year positive in 32 of the last 42 years (76% of the time) and produced an annual compounded return of 12.1%. This graph shows each year’s largest intra-year decline, represented by the red dot, and the return of the S&P 500 for each year overall, represented by the grey bar.

So far for 2022, the largest intra-year decline for the S&P 500 is -14.2%. This low happened on February 24th. While it is difficult to experience such a drop, this type of decline is in line with historic norms. Since the low on February 24th, the S&P 500 is up 10.1% (as of 3/31/2022). This shows why discipline is so important when it comes to investing and reinforces the importance of our message from February 24th – avoid making portfolio changes based on average intra-year volatility. It is imperative to stay invested and not make portfolio decisions based on the “exogenous variable du jour” (in this case the Ukrainian invasion).

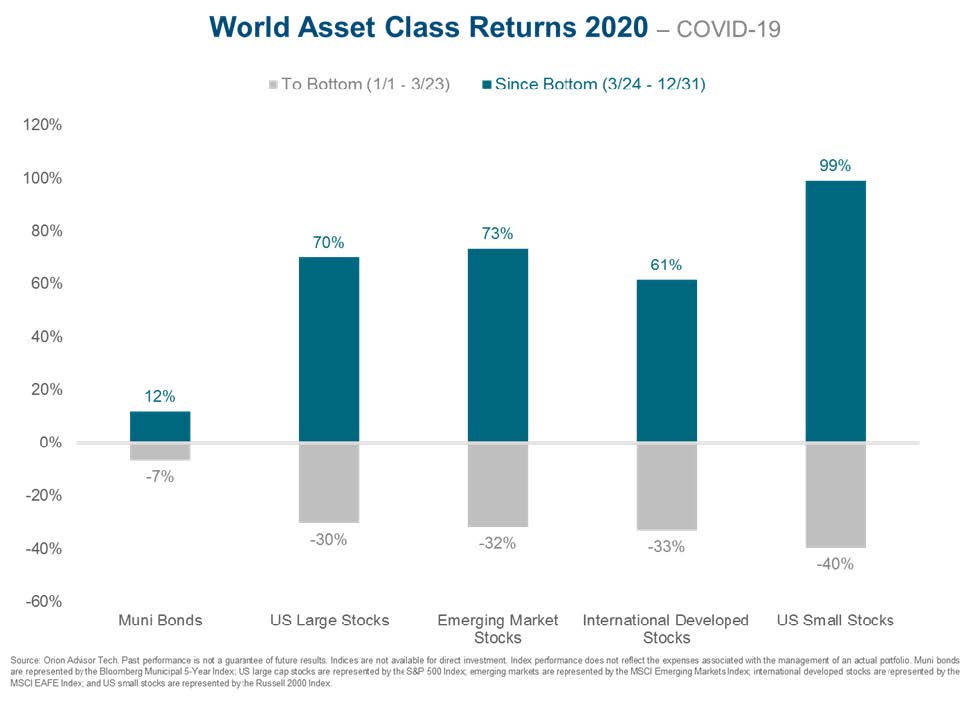

History tends to repeat itself, or at least rhyme. In 2020, the global markets experienced a sharp decline due to fears associated with COVID-19, bottoming on March 23rd, 2020. Following this sharp decline, the markets roared back with many asset classes finishing the year positive. Disciplined investors experienced positive returns in 2020. The below graph represents this – the grey bars show the return of their respective asset class from the beginning of the year through March 23rd (the 2020 bottom). The blue bars show the return of each asset class from March 24th through the end of the year.

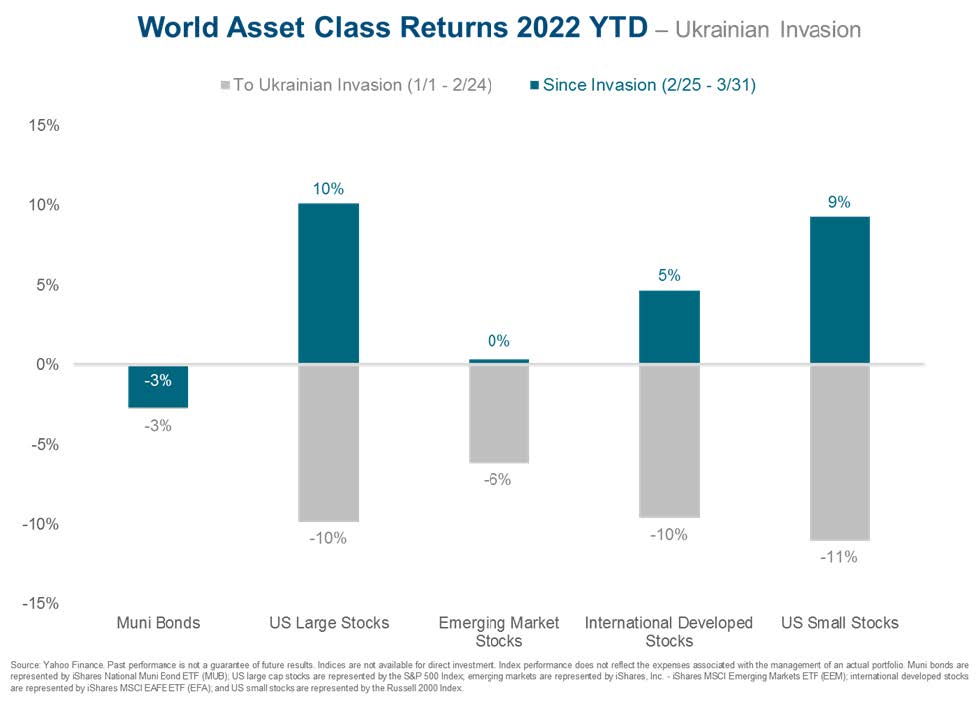

In 2022, we are experiencing a similar market reaction. The markets started the year down due to fears of inflation, rising interest rates, followed by the Russia/Ukraine conflict. As previously mentioned, the S&P 500’s low for the year was on February 24th, the morning of the Ukrainian invasion. Since then, most asset classes have experienced positive returns. The below graph shows this:

Moving Forward:

We are witnessing a tectonic shift in the world’s geopolitical order, engineered by Russia’s tragic war on Ukraine. Commodity prices, specifically oil, have surged. The offshoring of manufacturing to Asia has run afoul as severe supply chain issues remain. There is a growing realism that China cannot be relied on to be a rational actor. On top of all this, we find ourselves in the throes of the most severe inflation outbreak in nearly 40 years.

No one can predict how these problems will resolve themselves. We cannot possibly forecast how the capital markets will respond to their progression or resolution. We are in a fog of uncertainty and unknowing.

What we do know, and have great clarity on, is that current events are irrelevant to the investment policy of the long-term investor, especially the long-term equity investor. Continuing to practice rationality in the midst of uncertainty is the essence of the successful long-term investor. This means basing our investment policy on a personal financial plan – as distinctly opposed to an opinion of the economy or markets. Our advice continues to be the same – start with a plan, understand why you are investing, diversify for safety, and then stay invested and stay disciplined. During this volatility, we will continue to add value to your portfolio by tax-loss harvesting and rebalancing.

None of this is to make light of what has happened in Ukraine or any negative returns in your portfolio. Our hearts go out to all of those affected by this awful war. The media, in their attempt to sell newspapers and garner clicks online, tend to focus on the most disturbing and troubling events and outcomes. It is best to not let this affect your investment portfolio decision-making. We pray for a swift and peaceful resolution to the conflict. As always, please do not hesitate to reach out with any questions or concerns.

Best regards,

P.S. While I signed this memo, I want to credit our newest colleague, Brendan McEwan, with much of its content and graphical design. You’ll hear more about Brendan in the near future, he is a talented addition to our firm.