RZH Insights – The Recession Guessing Game

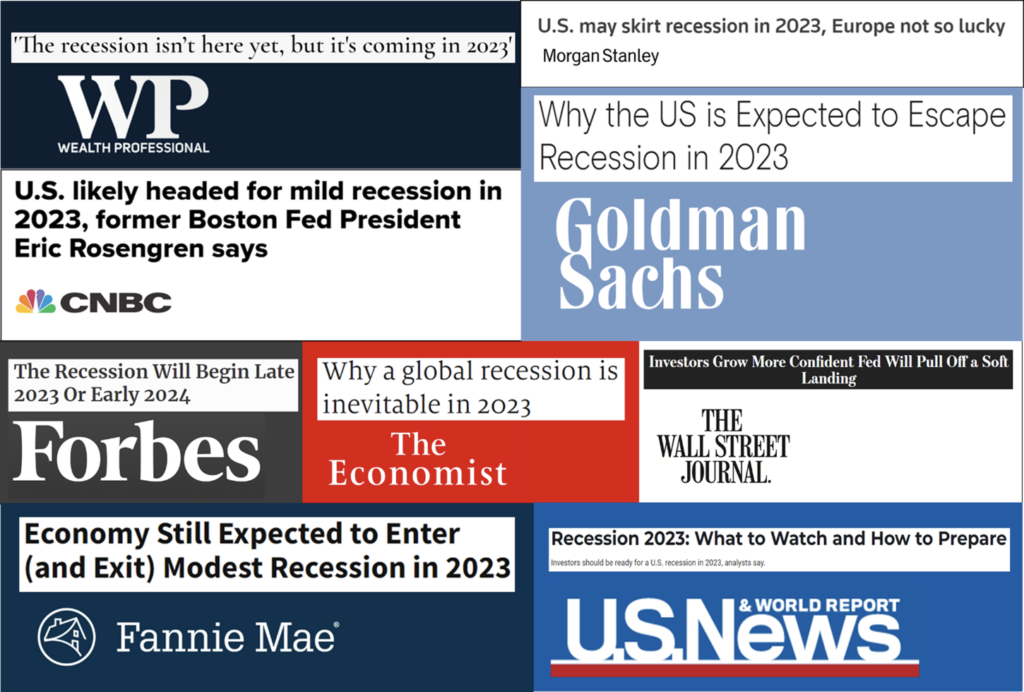

There have been a lot of headlines recently about the possibility of a recession in 2023. Here are a few examples:

As you can see, economic predictions for 2023 are all over the map as is often the case. As the saying goes, “economists have predicted 9 out of the last 5 recessions”. What’s interesting is that each prediction, which is about something so historically hard to predict, is said with such conviction that it leads you to believe the author’s opinion and wonder “what do they know that I don’t?”.

Predicting stock market returns is equally as challenging. “Expert” projections for 2022 (made at the end of 2021) ended up being far from reality. The median “expert” forecasts for the S&P 500 were about 26% higher than where it closed at year-end.1 The most bullish forecast was about 38% higher and the closest forecast was still about 15% higher than where the S&P 500 ended 2022.2 Let that sink in for a moment, the best projection of the top forecasters was off by 15%! That’s comparable to a meteorologist telling you it will be cold and snowing, but when you go outside it’s warm and sunny. If that happened consistently, you would not trust that meteorologist for long.

The argument as to why the projections of so many “experts” were off in 2022 is that “there were a lot of unpredictables last year.” The “unpredictables” were Russia’s invasion of Ukraine, China’s continued COVID shutdowns, persistent global inflation, and the energy crisis in Europe, among others. As we have previously stated, every year has its own exogenous variable du jour. It is often extremely difficult to predict and even harder to determine how the investment markets will react to these unforeseen events.

All of these events have led to the great debate of whether we will see a recession in 2023. As you can tell by the headlines above, there is no overarching consensus about whether or not a recession will occur, how bad it will be, how long it will last, if we are currently in one, or even what the definition of a recession actually is! But, even if there was a consensus, should we believe it? The most economically well-versed experts tried to predict what would happen in 2022 and missed by a mile.

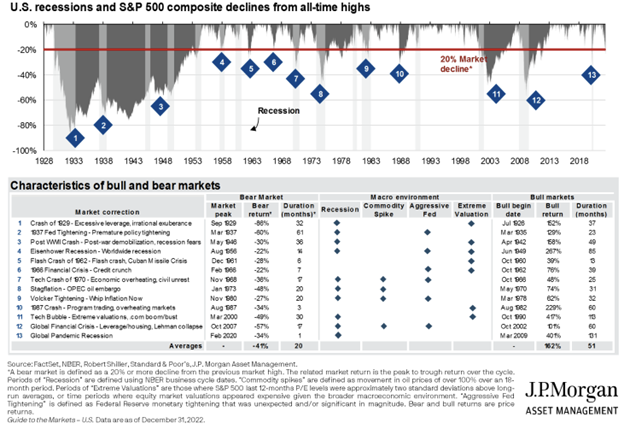

In reality, no one knows whether a recession will occur in 2023, 2024, or anytime thereafter. A broad definition of a recession is “a significant, pervasive, and persistent decline in economic activity.” Economists measure a recession’s length from the prior expansion’s peak to the downturn’s trough. By its definition, a recession is usually only determined AFTER it has already occurred. Recessions are not rare: economies are in a state of recession 10-12 percent of the time.3 Since The Great Depression in 1929, there have been 13 recessions, averaging out to about one recession every seven years. Each recession, its duration, return, and subsequent bull run is detailed in J.P. Morgan’s chart here.

In a recent article, Ben Carlson stated, “One thing is for sure – we are NOT in a recession right now. The 4th quarter of last year saw real GDP grow at an annualized pace of 2.9%. On the whole, the U.S. economy grew 2.1% in 2022 (even after accounting for inflation). Combine this with a 3.5% unemployment rate and it would be impossible to call the current environment a slowdown… Everyone has been worrying about a recession for more than a year now already so it’s not like these risks are unknown.” Perhaps this “inevitable” recession is already priced into the markets.4

If past predictions are any indication, 2023 will likely surprise us with results far from consensus. No one has ever been able to consistently predict what will happen in the economy. The only proven strategy to endure the ups and downs of the markets is to approach investing with a long-term and disciplined approach.

The investment markets are a forward-looking mechanism and often begin to recover before a recession is over. As Jeremy Seigel states in his famous book Stocks for the Long Run, “by the time the economy has reached the end of the recession, the stock market has already risen on average 25% from its low, therefore, an investor waiting for tangible evidence that the business cycle has hit bottom has already missed a very substantial rise in the market”.5

At RZH Advisors, we feel that adhering to our investment principles is especially important if you are faced with the uncertainties present in today’s markets. These principles are:

- Faith in the Future – The investment markets have historically increased over long-time frames. Investing contrary to 200 years of history has proven detrimental.

- Patience – Tolerating interim volatility allows markets to complete their full cycle. This allows different asset classes to benefit from historical performance patterns.

- Discipline – Sticking to your financial plan by following time-tested strategies and investment management principles during times of maximum uncertainty.

- Asset Allocation – Risk and return are related. The investment mix of stocks, bonds, and cash will be the primary determinant of portfolio return on a long-term basis.

- Diversification – Being broadly diversified within each asset class further reduces risk without reducing potential returns.

- Rebalancing – The disciplined art of systematically reallocating your portfolio back to its original target allocation. When implemented properly, the result is “buy low, sell high”.

We are here to help you navigate the uncertainties and the temptations of human nature which often provokes you to question these principles. Through our planning process, we design custom-tailored portfolios with a thoughtfully crafted balance of stocks, bonds, and cash for each client’s particular situation. While past performance does not guarantee future results, our portfolios are designed to support you through the challenges present in today’s market environment allowing you to continue to live the life to which you have grown accustomed. We achieve this by following our recession playbook which has been developed to mitigate the effects of market volatility: keep 1-2 years of cash flow needs on the sidelines, maintain 4-5 additional years of investment-grade short/intermediate-term bonds, and own predominately large-cap blue-chip stocks. It is equally important to consistently monitor your plan by employing strategies such as rebalancing, tax-loss-harvesting, investing available cash to take advantage of depressed stock prices, and avoiding large expenses when the market is down.

A recession, or a decline in the investment markets, does not imply a permanent loss in your portfolio. That can only occur if there is an imprudent reaction to headlines or volatility in the markets. RZH Advisors is here to help you navigate the challenges associated with maintaining a disciplined and successful investment experience.

Whether or not a recession occurs in 2023, our goal is to help you and your family reach your long-term goals. We are always here for you and encourage you to reach out at any time with questions or thoughts. Thank you for being our clients!

Best Regards,

Brendan McEwan

Financial Advisor

Please click here for important disclosure information.

- [1] Sommer, Jeff. “Forget Stock Predictions for Next Year. Focus on the Next Decade.” The New York Times, December 17, 2022. https://www.nytimes.com/2022/12/16/business/economy/stock-market-forecast.html.

- [2] Goodkind, Nicole. “Wall Street’s Dirty Secret: It’s Terrible at Forecasting Stocks.” CNN, December 28, 2022. https://edition.cnn.com/2022/12/28/investing/premarket-stocks-trading/index.html.

- [3] Investopedia. “Recession: What Is It and What Causes It,” November 17, 2022. https://www.investopedia.com/terms/r/recession.asp.

- [4] Carlson, Ben. “6 Questions I’m Pondering,” January 27, 2023. https://awealthofcommonsense.com/2023/01/6-questions-im-pondering/.

- [5} Guide to Financial Market Returns & Long-Term Investment Strategies (6th ed.). McGraw Hill. Siegel, J. (2022). Tocks for the Long Run: The Definitive Guide to Financial Market Returns and Long-Term Investment Strategies