RZH Insights: Mid-Year-ish Update and Timely Perspective

Every year brings its own surprises and uncertainties, and 2025 is no exception. While I will address recent events shortly, it is worth beginning with a reminder of the enduring principles that anchor successful wealth management. These guiding truths continue to shape our approach in working toward your objectives.

GENERAL PRINCIPLES

- We are goal-focused, plan-driven, primarily long-term equity-oriented investors. Our portfolios are derived from, and driven by, your most important lifetime financial goals, not from any view of the economy or the markets.

- We don’t believe the economy can be consistently forecast, or the markets consistently timed. Nor do we believe it is possible to gain any advantage by going in and out of the stock market, regardless of current conditions.

- We therefore believe that the most efficient method of capturing the full premium compound return of equities is by remaining fully invested. We believe that even in challenging periods, reinvested dividends and disciplined portfolio rebalancing allow us to purchase more shares at lower prices – positioning you to benefit from the long-term power of equity compounding.

- We believe that the greatest risk for long-term investors is not short-term volatility, but rather, not achieving your long-term goals.

CURRENT COMMENTARY

Ho-Hum, the stock market is already up over 10% this year, just like five of the last six years! 1

- If you looked at the stock market on the first trading day of this year, and not again until today, you could be forgiven for concluding that not much, if anything, had happened. In fact, a great deal has happened – but at least, so far, to no lasting effect.

- The S&P 500 Index reached a new all-time high on February 19th.2 By April 7th, it had fallen 21%3 (on an intra-day basis). And even that doesn’t express the degree of sheer panic (there’s no other word for it) that enveloped the markets upon President Trump’s announcement (on April 2) of a dramatically increased tariff protocol.

- The panic ended abruptly after President Trump announced a 90-day postponement of most of the new tariffs. In the months that followed – buoyed by continued economic strength and signs of moderating inflation – the S&P 500 Index returned to record highs, rising an astonishing 33% from its April 7th low.4

- As it virtually always is, the optimal course of action for long-term investors was simply to continue following your plan. That’s what we encouraged our clients to do. And as the second half of the year continues, that recommendation stands. Please don’t mistake this for an economic or market outlook. We have no such forecast for the next five months, any more than we did on January 1st.

- Our only forecast is that the excellent companies in our portfolios will continue managing challenges and innovating over time – increasing their earnings, raising their dividends, and supporting our client’s pursuit of their long-term goals.

- Panic doesn’t often seize the investing public as suddenly as it did in the first week of April, nor vanish as suddenly as it did the following week. Still, this episode can and should serve as a tutorial.

- Its lesson: investors succeed over time by consistently following their plan regardless of the latest “crisis.” Others often fail by reacting to negative events and liquidating even the highest quality stocks (great companies) at panic prices. We believe this is a fundamental choice in investing (and our mission, which we cherish) to help you continue making the wise choice.

PERSPECTIVES IN TIMES OF UNCERTAINTY: LESSONS FROM THE ‘70S AND TODAY

For many of us, the 1970s evoke memories of turmoil – economically, politically, and geopolitically. Inflation surged. President Nixon severed the link between the U.S. dollar and gold. The S&P 500 Index lost nearly half its value between 1973 and 19745 and didn’t reclaim its previous high for the better part of a decade. The oil embargo, Watergate, Vietnam, and a deep recession defined an era widely regarded as a “lost decade” for investors.

The President, the Federal Reserve and US fiscal policies were held in low regard. Sound familiar?

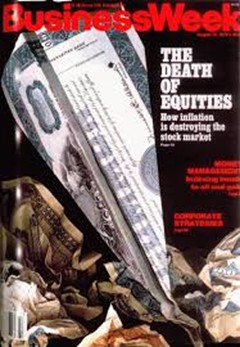

Business Week even declared “The Death of Equities” on its cover on August 13, 1979 – proclaiming that we should “regard the death of equities as a near-permanent condition”.6

But history is often more nuanced than headlines allow. While investors saw stagnation and political turmoil on the surface, a quiet revolution was unfolding beneath.

Just months after the gold standard was abandoned in 1971, Intel introduced the first commercially available microprocessor laying the foundation for the computer revolution.7 By 1975 and 1976, Microsoft and Apple were born – companies now valued at a combined $7.3 trillion.8

In hindsight, it’s a profound reminder: innovation doesn’t wait for calmer waters. It advances – even in the face of fear, volatility, and skepticism. Sometimes the most transformative opportunities are often born during periods of maximum discomfort – think AI (Artificial Intelligence) recently.

For those who remained invested, the results were extraordinary. From the time of that infamous magazine cover in August 1979 through July of this year (46 years) the S&P 500, assuming dividends were reinvested, compounded at 12.01% annually. In other words, a $1,000,000 investment would have grown to $184,000,000 (excluding taxes).9 Take a moment and re-read that last sentence. Now read it again!

For most of our clients, the majority of their beneficiaries will easily live for another 46 years. At RZH we are not investing for “what will happen next”, we are investing for what will ultimately happen over the balance of your investing lifetime – and beyond, to the extent that legacy and generational wealth is part of your plan.

Crises end. Markets recover. Innovation endures.

Today’s headlines may be unsettling, but for investors with vision, discipline, and a structured plan, they need not be paralyzing. Our role as your advisors is to help you look past the noise – focusing not on what may happen next, but on what is most likely to unfold over the course of your financial life and legacy.

As Winston Churchill once said, “The farther backward you can look, the farther forward you can see.”

Let’s continue to look forward – together.

We welcome your comments and questions. Thank you, as always, for being our clients. It is a privilege to serve you.

May you be enjoying a wonderful summer,

Carl J. Zuckerberg, CFP®, AIF®, CIMA®

Principal, Chief Investment Strategist

[1] Total Return of S&P 500 Index assuming dividend reinvestment from January 1, 2025, through August 12, 2025. Investors cannot directly purchase an index.

[2] Yahoo Finance. S&P 500 Index intraday high (6,147).

[3] Yahoo Finance. Performance of S&P 500 Index as calculated from intraday high (6,147) on February 19, 2025, through intraday low (4,835) on April 7, 2025.

[4] Yahoo Finance. Performance of S&P 500 Index as calculated from the intraday low (4,835) on April 7, 2025, through market close (6,445.76) on August 12, 2025.

[5] Yahoo Finance S&P Index Historical Data. S&P Index return calculated from market close (120.24) on January 11, 1973, through market close (62.28) on October 3, 1974.

[6] It’s Been 40 Years Since our Cover Story Declared “The Death of Equities”. Bloomberg BusinessWeek. August 13, 2019.

[7] Intel Introduces the First Computer on a Chip. EBSCO Information Services. 2023.

[8] Yahoo Finance. Combined market capitalization of Microsoft Corporation (MSFT: $3.91T) and Apple Inc (AAPL: $3.44T) as of August 12, 2025.

[9] S&P 500 Index Historical Calculation of 12.01% for the average of closing prices for the month of August 1979 through the month July 2025. Depicted investment performance assumes dividend reinvestment. For illustration purposes only, an investor cannot directly purchase an index.