RZH Insights – A Roller Coaster of a Riddle

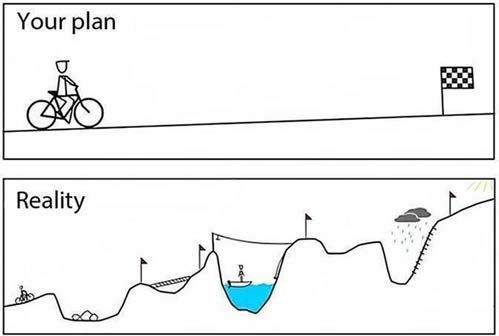

What goes down 12%, then up 11%, then down 20%, then up 17%, then down 9%, then up 5% then down 11%? You unfortunately already know the answer…it’s this year’s stock market! These are the actual movements since January 1st, leaving the S&P 500 down 22% for the year.

Are you exhausted yet? You are not alone, most RZH clients are as well.

For an explanation of why this is happening please refer to my Q2 memo HERE. Since then, we’ve had even worse inflation news and an even stronger response from the Federal Reserve which has triggered this latest downturn. The market is adjusting to higher interest rates, less liquidity, and the realization that the era of the “Fed put” is over.

Is there any precedent for this – yes:

- There have been 14 bear markets (including this one) and 13 recessions since World War II – an average of one about every 6 years.

- The average bear market decline is -32.7% which implies that this bear market could see further downside. I would not be surprised to see this, especially given the myriad of global geopolitical risks, continued inflation surprises, and the Fed’s desire to remove liquidity from the system.

- The good news is that the average bear market lasts 367 days, so we may already be 75% of the way through this one.

- A silver lining is that you can finally earn some interest on cash and bonds. A two-year Treasury bond yields over 4% – up from .26% just a year ago

Each bear market and recession is unique in its own way. This one is unlike anything we’ve seen before given the confluence of the pandemic, excessive government stimulus, persistent inflation, European energy crisis, supply chain shocks, the Ukraine war, etc. Every bear market causes feelings of panic and despair. They make you question your investment plan and previously held investing beliefs. All bear markets are painful – every single one of them.

Emotions are running high, and an important part of our job is to help clients reject emotional responses in favor of rational decision-making. Bear markets are when individuals and families protect their long-term wealth and ensure a more predictable future by not panicking and instead sticking to a well-designed plan. Our clients have custom-tailored financial plans whereby each dollar invested has a specific role in achieving an important personal objective. The worst plan is the one not followed, especially in the face of provocation such as this market environment and media hysteria.

Neither I (nor any other honest person) knows when this will end, but we do know that it will end. To plan any differently would be ignoring 200 years of history. I believe that forming investment policy based on predictions, instead of evidence, is very dangerous.

In the meantime, it is more important than ever to follow the pre-mentioned bear market/recession playbook: keep 1-2 years of cash flow needs on the sidelines, maintain 4-5 additional years of investment-grade short/intermediate-term bonds and own predominately large-cap, blue-chip stocks. It is equally important to keep working on your plan by rebalancing, tax-loss-harvesting, avoiding large expenses when the market is down, and investing available cash to take advantage of depressed stock prices. For more on this please re-read Dana’s Three Bucket Theory memo HERE.

At RZH we’ve successfully navigated through many bear markets and recessions. I’m sure this won’t be the last. We are always here to talk this through with you and answer your questions. Thank you for being our clients. It is a privilege to serve you.

Best regards,

Extra content: The majority of our equity holdings are those which comprise the S&P 500 and their international counterparts. This is not a random set of stocks or merely a “passive” index. Unbeknownst to many, the S&P 500 is a thoughtfully selected and carefully managed portfolio of the largest, most soundly financed, best managed, most profitable, most innovative, and most transparent companies serving America and the world. For an insightful explanation of how to think about these stocks (versus the “stock market”) please click on THIS MEMO or ask me to walk you through a seminar I gave on this topic. The bottom line is that the long-term upward trend of stocks does not occur in a straight line. So, perhaps consider the accompanying volatility as simply the price of admission to owning an asset class that has produced compounded returns of 10% annually.

Some material, content, and statistics are derived from Ben Carlson’s blog A Wealth of Common Sense, and the Nick Murray Interactive newsletter