RZH Insights – The Cycle is Complete

On Friday, January 19, the S&P 500 Index closed at a record high, completing the bear market cycle, and ending a two-year period below its last peak on January 3, 20221. The S&P 500 continued moving higher this week. While a two-year gap between closing highs might seem lengthy, historically, it is shorter than average.

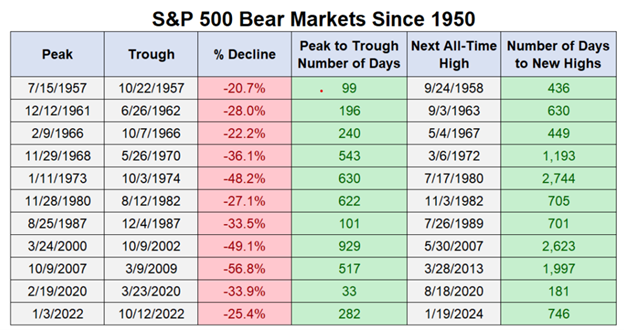

The chart below illustrates S&P 500 bear markets since 1950. It shows that the duration of the 2022 bear market was milder than average. The average peak-to-trough for bear markets has historically been 391 days, while the 2022 bear market only lasted 282 days. The average number of days to new highs has historically been 1,166 days, however, this market recaptured its high in only 746 days.

“New All-Time Highs After a Bear Market”. January 21, 2024. https://awealthofcommonsense.com/2024/01/new-all-time-highs-after-a-bear-market/

While the 2022 bear market was less severe than average, if you were to read the predictions of many highly respected “experts”, you may not have believed this was possible… “Why a global recession is inevitable in 2023”was the actual headline of an article in The Economist written on November 18th, 2022.2 We referenced this in our February 2023 newsletter titled “The Recession Guessing Game”. In this newsletter we state, “If past predictions are any indication, 2023 will likely surprise us with results far from consensus. No one has ever been able to consistently predict what will happen in the economy.” We continue to believe that the only proven strategy to endure the ups and downs of the markets is to approach investing with a well-thought-out plan and disciplined approach.

In addition to The Economist’s headline, other dire predictions had people nervous about investing last year as well. Jeremy Grantham predicted that, “The S&P 500 could tank by over 50%…”3 Jamie Dimon warned Americans to “brace yourself for an economic hurricane…”4 Finally, Goldman Sachs predicted that the bear market would “get deeper in 2023…”5

Fortunately, these ominous predictions did not materialize, and resilient US companies were able to persevere. Similar predictions continue to make headlines today, but the truth remains – predicting how the markets will perform is a difficult task. As Yogi Berra stated: “It is difficult to make predictions, especially about the future.” RZH continues to abide by our mantra; the economy cannot be consistently forecast, and the markets cannot be consistently timed.

Fortunately, historical trends do provide some guidance and reasons for optimism. Throughout history, instances where there’s been a minimum one-year gap between S&P 500 highs have typically resulted in strong performance in the subsequent year. Since 1950, the average gain of the S&P 500 for the 12 months following a new high with a gap of a year or more was 14%.6

In June 2023, we published a newsletter titled “The Stealth Bull Market”, which discussed the remarkable turnaround of the S&P 500 amidst various negative factors, including inflation, Federal Reserve interest rate speculation, a banking crisis, US/China tensions, and a debt ceiling emergency. Several of these issues remain unresolved, with the addition of the Israel–Hamas war and uncertainties related to the upcoming US presidential election. Despite these ongoing uncertainties and negative news, the S&P 500 continues to reach new highs. While these topics may dominate headlines in the coming year, we remain optimistic that the financial plans we’ve developed for our clients position them to continue living their best lives, regardless of short-term market volatility.

Our goal remains to help our clients and their families reach their long-term goals, knowing they have a plan in place, making short-term market fluctuations irrelevant to their financial security. We are always here for you and encourage you to reach out for more perspective on market cycles or insights into how your portfolio is positioned to deal with an unpredictable future.

Thank you for being our clients!

Best Regards,

Brendan McEwan CFP® CIMA®

Senior Financial Advisor

[1] “S&P 500 Historical Performance”. https://finance.yahoo.com/quote/%5EGSPC/history?p=%5EGSPC

[2] “Why a Global Recession is Inevitable in 2023”. November 18, 2022. https://www.economist.com/the-world-ahead/2022/11/18/why-a-global-recession-is-inevitable-in-2023

[3] “Brace for the S&P 500 to plunge 50% and a painful recession to strike as the ‘everything bubble’ bursts, elite investor Jeremy Grantham warns”. March 21, 2023. https://finance.yahoo.com/news/brace-p-500-plunge-50-134507664.html

[4] “Jamie Dimon says ‘brace yourself’ for an economic hurricane caused by the Fed and Ukraine war”. June 1, 2022. https://www.cnbc.com/2022/06/01/jamie-dimon-says-brace-yourself-for-an-economic-hurricane-caused-by-the-fed-and-ukraine-war.html

[5] “The Bear Market in Global Stocks is Forecast to Get Deeper in 2023”. November 23, 2022. https://www.goldmansachs.com/intelligence/pages/why-the-bear-market-in-global-stocks-is-forecast-to-get-deeper-in-2023.html

[6] “The stock market took a long pause between record highs. History says this is great news.” January 23, 2024. https://finance.yahoo.com/news/the-stock-market-took-a-long-pause-between-record-highs-history-says-this-is-great-news-110401610.html