RZH Insights – The Stealth Bull Market

If a bull tiptoes through a china shop, does anyone know it’s there?

During mid-October, the U.S. stock market was undergoing a challenging bear market. Inflation rates remained high at nearly 8% annually1, and the Federal Reserve was actively increasing interest rates. At that time, both the S&P 500 and the Nasdaq 100 had experienced significant declines of over 25% and 35% respectively from their previous peaks1. The situation appeared grim, as there was no clear indication of a market recovery.

However, since mid-October, there has been a remarkable turnaround – one that we have been referring to as a “stealth bull market” due to the lack of press it has received. The rise has been lumpy and overshadowed by continued inflation news, Federal Reserve interest rate speculation, a banking crisis, US/China tensions, a debt ceiling emergency, and the Taylor Swift world tour.

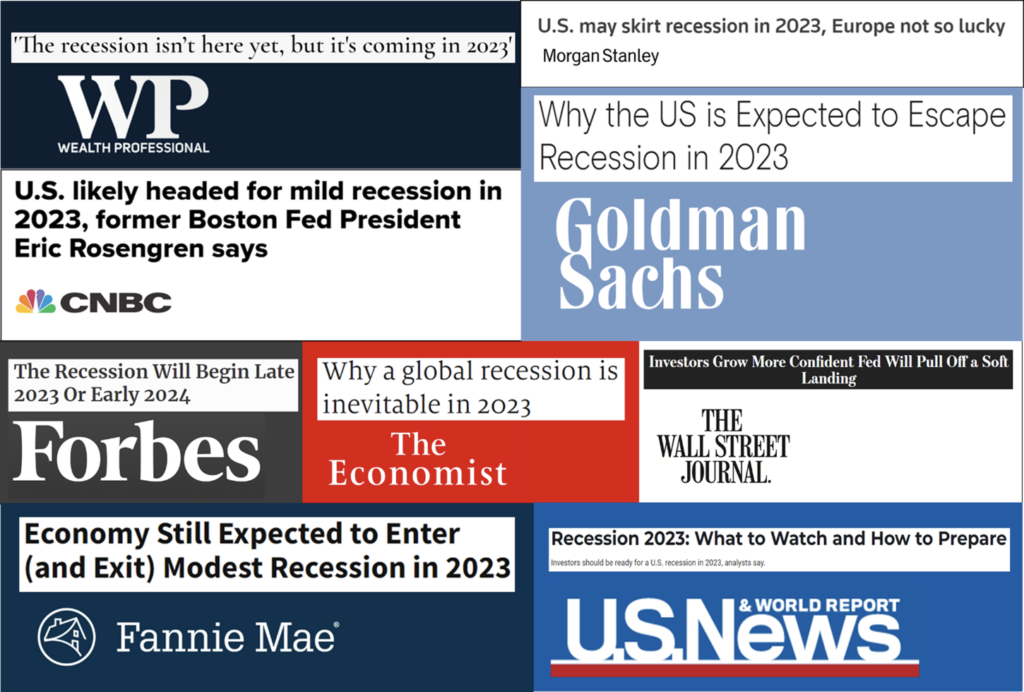

From the October 2022 lows, the Nasdaq 100 has surged by an impressive 37%, while the S&P 500 has risen over 20%. Although the market is still below its all-time highs, this rally has defied predictions of a recession made by many experts over the past 18-24 months.

Now the question arises: Is the bear market over? Are we witnessing the start of a new bull market? As always, it is difficult to say for certain, considering the confusing nature of the stock market during such times. A prime example is the largest company in the U.S. stock market, Apple. Last summer, its share price nearly fell 30% from its all-time high, followed by a 36% rally, then dropped nearly another 30%, and is now approaching its peak once again with a 48%+ rally1. This is all in the span of 18 months!

These fluctuations demonstrate the back-and-forth nature of the market, with alternating bull and bear phases. While we may have technically reached the definition of a “bull market”, as the stock market is now 20% above its October 2022 lows, such classifications primarily matter only to market participants. The true answer can only be determined with the passage of time.

It is worth remembering that the renowned bull market of the 1980s and 1990s is commonly believed to have started in the early 1980s. However, from the end of the bear market in late 1974 until the end of 1979, the S&P 500 had already risen by nearly 120% in total or 16% annually1. This often goes unnoticed due to the challenging financial environment of the 1970s. Similarly, it took until 2013 for the S&P 500 to surpass its pre-Great Financial Crisis highs, despite having risen more than 150%, or about 25% annually, from the 2009 lows. In the end, does it truly matter whether these gains occurred during a technical bull market or just a bear market rally?

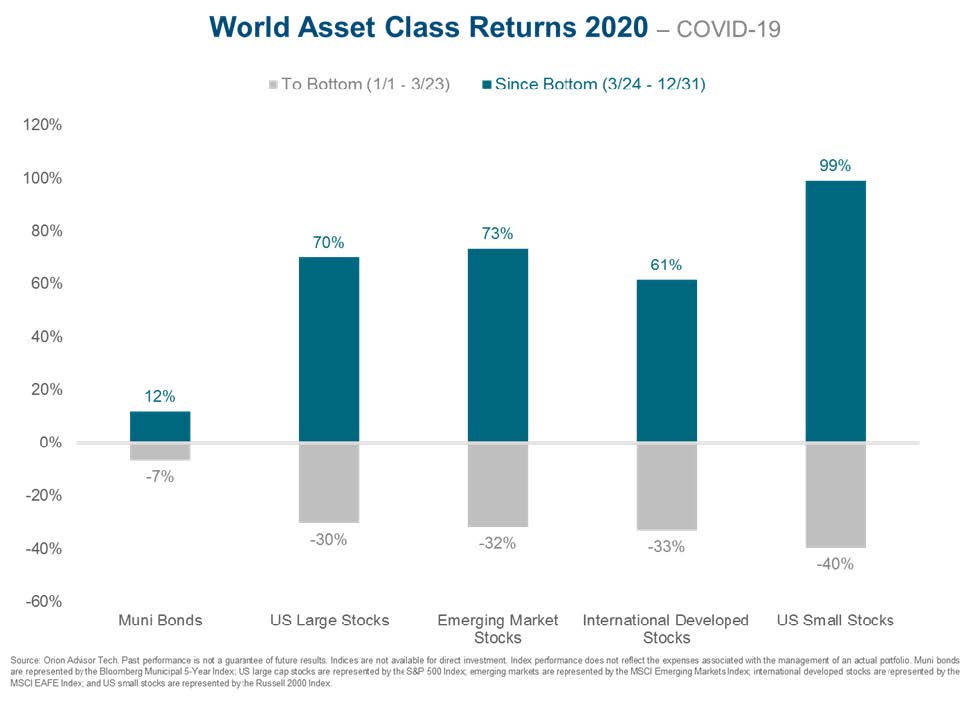

While it is not guaranteed that history will repeat itself, during the “lost decade” of the 2000s many individuals became conditioned to believe that every downturn would result in a catastrophe – as the media tends to espouse and continually reinforce. The same sentiment appears pervasive today. However, bear markets typically occur once every five years…so it is possible (actually quite common) to have a bear market without the world completely unraveling in the process.

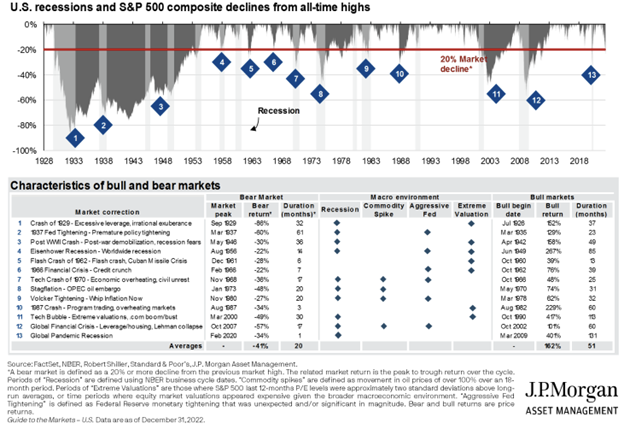

No one can perfectly time market highs or lows. The emotions of panic during a downtrend and euphoria during an uptrend may be similar, but each bull and bear market has its own unique characteristics, making predictions challenging.

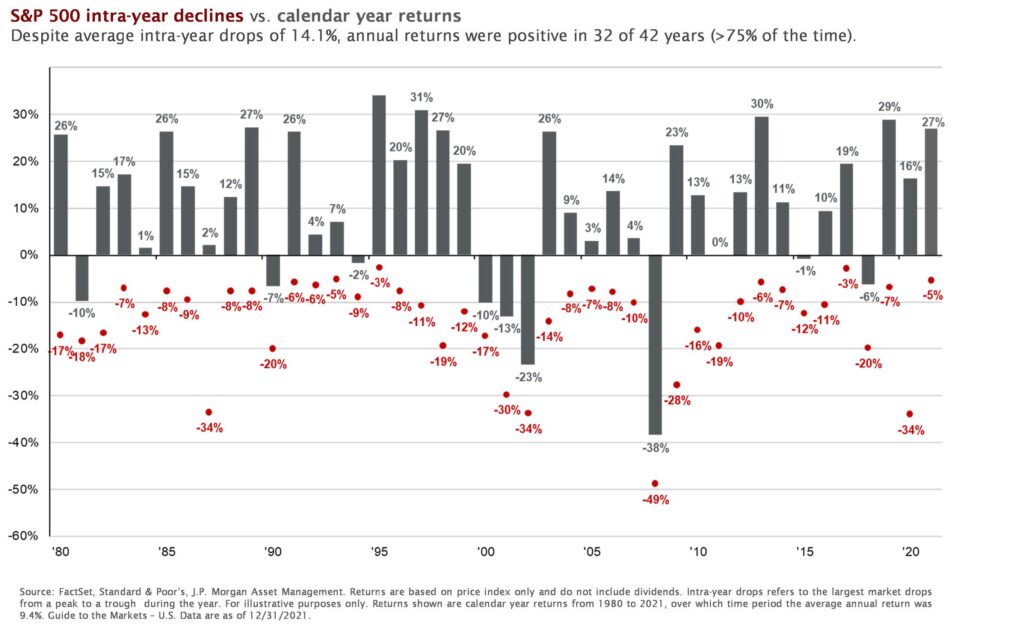

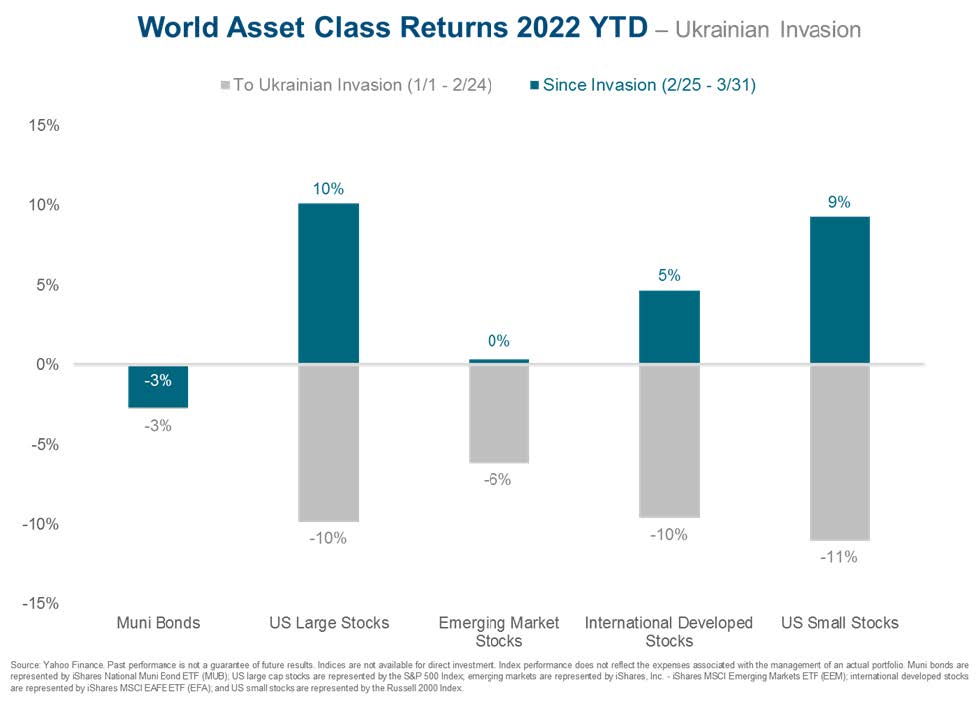

We never know how high a bull market will climb or how long it will last. Similarly, as illustrated in the chart below, we cannot anticipate how low a bear market will go or its duration. Even if we are currently in a new bull market, there is likely to be a pullback in the coming year. Over the past 43 years, the average intra-year decline has been about 14%2.

In terms of understanding bull and bear markets, it is important to recognize that the long-term trend is generally upward, but short-term downturns are inevitable. The lows are (and always have been) temporary and the highs are ever-reoccurring.

Our feelings remain unchanged…the economy cannot be forecast, and the markets cannot be timed. Having a plan is imperative and patience is always rewarded in investing. Our client’s financial plans are designed with the understanding that we will encounter various bull and bear markets throughout the years.

Together we will navigate these challenging times as well – by continuing to manage your plan, adhering to the principles of successful investing, and staying focused on your most cherished financial objectives. We are always here for you and encourage you to reach out at any time with questions or thoughts.

Thank you for being our clients, it is a genuine privilege to serve you.

Best wishes for a wonderful summer!

Carl J. Zuckerberg, CFP®, AIF®, CIMA®

Principal, Chief Investment Strategist

Please click here for important disclosure information.

1.Inflation data, S&P 500 Index performance, and NASDAQ 100 Index performance calculated for the period Jan 4, 2022 – October 12, 2022, using historical data sources from the Yahoo! Finance Historical Data tool. Apple performance calculated for the period Dec 2021 – June 2023. While we believe this data source to be reliable, its accuracy and completeness are not guaranteed. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security, and past performance is no guarantee of future results.

2.JP Morgan Guide to the Markets – Annual returns and intra-year declines: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/guide-to-the-markets-slides-us/equities/gtm-annualreturns/